Celebrating Child Tax Credit Awareness Day

Colleen Ross

June 21, 2021

Monday, June 21, 2021 is Child Tax Credit Awareness Day, a day to celebrate and spread the word about monthly payments that are starting soon that will support children and families across the country.

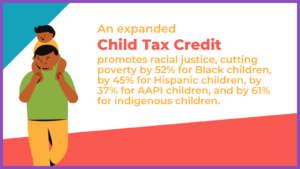

The American Rescue Plan, which passed in March 2021, included a historic expansion of the Child Tax Credit in 2021. The law increased the maximum Child Tax Credit from $2,000 to $3,000 per child for children ages 6-17 and from $2,000 to $3,600 for children under six, which can be received via monthly payments, with the exact payment varying by parents’ income. NETWORK has long advocated for this policy that uses our shared resources to invest in kids, increase racial equity, and support parents and communities.

The American Rescue Plan, which passed in March 2021, included a historic expansion of the Child Tax Credit in 2021. The law increased the maximum Child Tax Credit from $2,000 to $3,000 per child for children ages 6-17 and from $2,000 to $3,600 for children under six, which can be received via monthly payments, with the exact payment varying by parents’ income. NETWORK has long advocated for this policy that uses our shared resources to invest in kids, increase racial equity, and support parents and communities.

In July, monthly payments will start going out to families.

With monthly payments, families can count on this support each month to make ends meet. To help with the costs of raising children, families will begin to receive monthly payments of up to $250 for each child 6-17 years old and $300 for each child under age 6. The Child Tax Credit is fully refundable, meaning that if a family’s income tax bill is less than the amount of their Child Tax Credit, they will get a payment for the difference.

According to the Biden administration, the IRS estimates roughly 39 million households — almost 90% of children in the United States — will begin receiving monthly payments without any further action required. Other eligible families — those who have not yet filed taxes in 2019 or 2020 and who did not sign-up for Economic Impact Payments like the $1,400 rescue payments included in the American Rescue Plan — can still sign-up to receive monthly Child Tax Credit payments beginning this summer. Experts project that the expanded Child Tax Credit could potentially help lift one-half of all children out of poverty if all eligible families sign-up to receive the monthly payments.

The Child Tax Credit will not affect families’ Medicaid, SNAP, TANF Cash Assistance, SSI, or other public benefits, and monthly payments will be delivered via direct deposit to the bank account that the IRS has on file or sent to a family’s mailing address on or around the 15th of every month.

Make sure you get your Child Tax Credit payments!

If a family filed tax returns for 2019 or 2020 or signed up to receive a stimulus check from the IRS with the Non-Filer tool last year, they will automatically get the monthly Child Tax Credit. If they aren’t already signed up, it’s not too late to sign up to get the Child Tax Credit here: https://www.whitehouse.gov/child-tax-credit/sign-up/

Let’s make support for children and families permanent!

This one-year expansion of the Child Tax Credit is a massive advancement in ending childhood poverty. We know it is wrong when children and their families are struggling to make ends meet. It’s not good for families and it’s not good for our communities. We must make the expanded Child Tax Credit permanent in the next recovery package that Congress passes.

We are called to build anew by passing tax policies that make the wealthiest people and corporations pay their fair share – doing this allows us to invest in children and families.