Legislative Review of 2023

One of the Most Dysfunctional, Unproductive Congresses of Modern Times

Laura Peralta-Schulte

February 19, 2024

Following the 2022 midterm elections, 2023 brought “divided government” to Washington, DC as Republicans took control of the U.S. House of Representatives, while the Presidency and U.S. Senate remained under Democratic control.

Policymaking is always more difficult with a divided government because only compromise allows success. The federal system, by design, encourages deal-making and compromise, half-measures, and rare bipartisan achievements. The reactive nature of the federal system often frustrates those seeking revolutionary change.

The first session of the 118th Congress stands out as a year of abject legislative failure. It was a year of squandered opportunity, petty infighting, and deep frustration. The blame for this lack of progress lies directly at the feet of the House Republican Caucus and, by extension, former President Trump.

It is no secret the two major parties have competing visions on key policy issues. The key distinction between the parties is generally informed by what they believe to be the federal government’s proper role. These differences profoundly impact the lives of vulnerable people and the earth, our common home.

NETWORK’s Build Anew agenda requires an active federal government to address the social sins of the day: a broken, inhumane immigration and asylum system, shocking levels of wealth inequality and an ever-growing wage gap, increasing levels of child poverty, destruction of our planet, and more. NETWORK, in Washington and through the actions of our members back home, plays a critical role in bridging the divides to build support for core policy initiatives informed by Catholic Social teaching.

NETWORK’s Build Anew agenda requires an active federal government to address the social sins of the day: a broken, inhumane immigration and asylum system, shocking levels of wealth inequality and an ever-growing wage gap, increasing levels of child poverty, destruction of our planet, and more. NETWORK, in Washington and through the actions of our members back home, plays a critical role in bridging the divides to build support for core policy initiatives informed by Catholic Social teaching.

Why does this session stand out as being particularly troublesome? The design of the federal system remains the same; however, the norms of the system — civility and goodwill at minimum to a member’s party — have vanished. The problem did not start this year; institutional norms have slowly eroded, dating back to the speakership of Newt Gingrich and the government shutdowns of 1995 and 1996. The Trump administration accelerated this decay in Washington leading directly to the insurrection of January 6 and an attempted overthrow of the 2020 election.

The schism in the Republican party is most apparent in the House of Representatives and exists between two distinct factions: institutionalists, a quickly shrinking number of Members who respect traditional norms and recognize the need to compromise, and radicals, those who view compromise as capitulation and weakness and act with little regard for the institution or their fellow Republicans.

Tension between the two factions has been displayed in the House since the beginning of the term. This first became apparent during the nomination of Rep. Kevin McCarthy for Speaker of the House. A group of hardline House Republicans blocked McCarthy from securing the speakership to extract policy concessions to their radical agenda. McCarthy won the speakership after 15 humiliating votes. The nomination debate foreshadowed the tumult that was McCarthy’s short tenure as Speaker.

It is critical to note that Senate Republicans, led by Minority Leader Mitch McConnell, have largely rejected chaos, instead opting to collaborate with Senate Democrats to achieve mutual policy objectives. As 2023 came to a close, it was sadly apparent that a core issue that intersects both House and Senate Republicans’ agenda is a strong desire to end the U.S. asylum system and “build the wall.”

The radical nature of House Republican conservatives — in policy and political norms — is nothing less than shocking. Action on key policy initiatives stopped except for must-pass legislation — lifting the debt ceiling and passing two continuing resolutions to keep our government operational. Each bill moved forward only after House Republicans attempted to use the deadlines to alter core human needs programs for struggling families significantly. Then, after failing to develop a consensus among their caucus, the government was kept afloat due to the support of House Democrats under the leadership of House Minority Leader Hakeem Jeffries.

Cuts to poverty programs are being heralded by House conservatives as necessary austerity measures. The great irony is that the same House conservatives proposing to take food from babies are poised to spend billions of dollars for more tax cuts for the wealthy and corporations on top of the $2 trillion spent under President Trump’s Tax Cuts and Jobs Act passed in 2017.

Then-Speaker McCarthy lost his speakership due to passing a bipartisan continuing resolution with the support of Democrats in September. Compromise is the enemy of House conservatives, regardless of the chaos resulting from policy failure. Chaos is a key tactic and desired outcome.

It is worth noting that these radical members are working very closely with former President Trump in the lead-up to the 2024 election. Many are on record as election deniers and supporters of the insurrection. The former president urged these House Republicans to replace McCarthy in September. He rejected several candidates for Speaker to replace McCarthy, ultimately praising the nomination of ally Rep. Mike Johnson. It bears remembering that now-Speaker Johnson led the effort in the House to reverse Trump’s 2020 election loss.

The first session of a new Congress is typically a time when work gets done before the election cycle begins. Unlike previous congressional terms, the 2024 elections have been front and center in the House from day one. House legislative efforts have relentlessly attacked immigrants and U.S. asylum laws, voting rights, and the LGBTQ+ community.

There have been calls for book bans and ending diversity initiatives, attacks on the Internal Revenue Service as they actively work to ensure wealthy taxpayers pay their taxes, and drastic cuts on all key anti-poverty programs, including WIC, SNAP, healthcare, Social Security, Title One school funding, housing vouchers, and so much more. House Republicans also started formal impeachment processes for Department of Homeland Security Secretary Alejandro Mayorkas and President Biden.

There have been calls for book bans and ending diversity initiatives, attacks on the Internal Revenue Service as they actively work to ensure wealthy taxpayers pay their taxes, and drastic cuts on all key anti-poverty programs, including WIC, SNAP, healthcare, Social Security, Title One school funding, housing vouchers, and so much more. House Republicans also started formal impeachment processes for Department of Homeland Security Secretary Alejandro Mayorkas and President Biden.

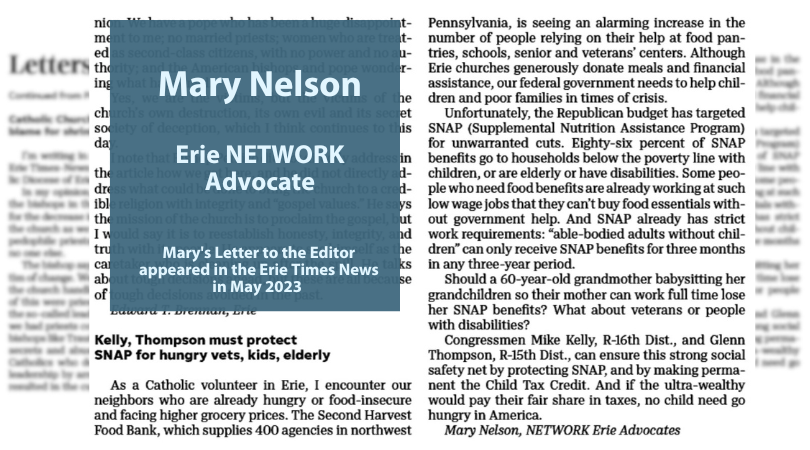

The House Agriculture bill provides a great example of the harsh austerity measures radical House members are seeking. After successfully making it harder for older Americans to receive SNAP in the new debt ceiling law, key provisions of the Agriculture bill were nothing less than a frontal attack on communities living with high rates of poverty. The bill had cruel cuts in funding to prevent hunger and food insecurity, including hallowing out key programs for fresh fruits and vegetables for children.

Shockingly, the bill would eviscerate long-standing bipartisan support for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) at a time of great need. A lack of funding means waiting lists, poorer health outcomes, and other hardships for new families and their babies.

House conservatives are heralding cuts to poverty programs as necessary austerity measures. The great irony is that the same House conservatives proposing to take food from babies are poised to spend billions of dollars for more tax cuts for the wealthy and corporations on top of the $2 trillion spent under President Trump’s Tax Cuts and Jobs Act passed in 2017.

As the year ends, Congress, due to inaction in the House, has pushed all decisions on major legislation into 2024, making this the most non-productive, dysfunctional Congress in the modern era. The House of Representatives completely failed in their responsibility to the American people. As always, the high cost of inaction falls hardest on the most vulnerable.