Faces of Occupy DC

By Eric Gibble

October 26, 2011

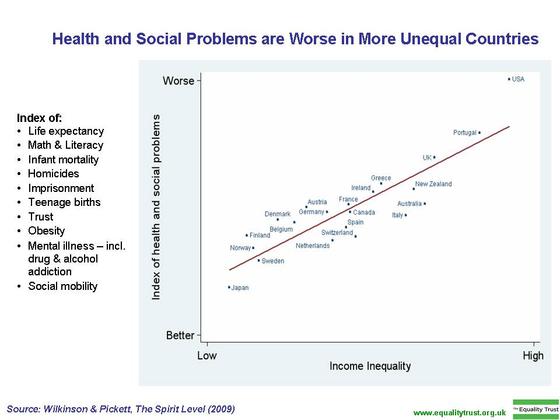

Occupy Wall Street began with a few hundred people protesting the greed of Wall Street in Zuccotti Park in New York City. It has now grown into a movement of tens of thousands of people across the globe. The 99% have made their voices heard on every continent, including Antarctica. Some have mocked the Occupy protesters. Others believe the movement will simply fade away over time. However, the reality is the underlying concerns driving the movement will not fade away. If the top 1% of earners continues to increase their share of the nation’s income like they have over the last three decades, the Occupy movement will increase in numbers.

I was able to participate in the beginning stages of Occupy DC on Oct. 6 with four other NETWORK staff members. What I saw were people simply trying to achieve the American Dream by ending the horrendous wealth gap in the United States.

Watch what Andrea from Atlantic City had to say about the movement.

We must remember that Americans participating in these protests are individuals with their own stories. Dispersing them with flash grenades and tear gas, like police in Oakland California did, will not disperse their message. And most importantly, it will not resolve the very real and disturbing wealth gap our country is faced with.

e White House on the idea of a summit on the wealth gap. We still intend to meet our goal of 10,000 signatures on the petition, and we will deliver all of them in future meetings, as we continue to educate elected officials as well as the public on the causes and consequences of the wealth gap in our country, and advocate for responses.

e White House on the idea of a summit on the wealth gap. We still intend to meet our goal of 10,000 signatures on the petition, and we will deliver all of them in future meetings, as we continue to educate elected officials as well as the public on the causes and consequences of the wealth gap in our country, and advocate for responses.