Rescission: What Will They Think of Next?!

Weaponizing an Obscure Procedure Will Further Undermine Our System of Government

Jarrett Smith

July 11, 2025

Last week, the reconciliation bill passed Congress and was signed into law by President Trump on the Fourth of July. Now, only a few days after people in the U.S. grilled hot dogs and hamburgers and watched fireworks light up the sky, Capitol Hill is debating another budget bill. However, this time, it is to claw back previously approved funding for programs President Trump does not like.

President Trump has proposed that Congress take away $9.4 billion in spending that was previous passed in the House on June 12. How can this happen, you ask? Well, Article I, Section 8 and 9 of the Constitution gives Congress the “power of the purse,” as we saw when Trump’s illegal efforts at the start of his second term to impound federal spending met with successful legal opinions. Unfortunately, that doesn’t mean he’s out of options.

Under the Impoundment Control Act of 1974, an administration can use specific processes for how and when a president can refuse to spend money that Congress has already appropriated. Under the statute, the president must send a “special” message to Congress explaining his reasons for impounding certain funds. One of his options is “rescission,” which is an option to cancel funding completely. For it to happen, both the House and Senate must approve the president’s request within 45 days. Unfortunately, it requires only a simple majority to pass.

The Impoundment Control Act came about in response to President Nixon abusing his power of impoundment to block spending for programs he didn’t like. And now we are seeing similar White House action. The same stuff, different day!

As the Center on Budget and Policy Priorities notes of President Trump’s rescission proposal: “The proposed cuts would significantly damage life-saving global health programs, peacekeeping efforts, and economic development abroad, and would hurt domestic community TV and radio stations supported by the Public Broadcasting Service (PBS) and National Public Radio (NPR).” Lives are at stake with this funding, including in rural areas in the U.S. that can only receive emergency information from the public broadcasting system.

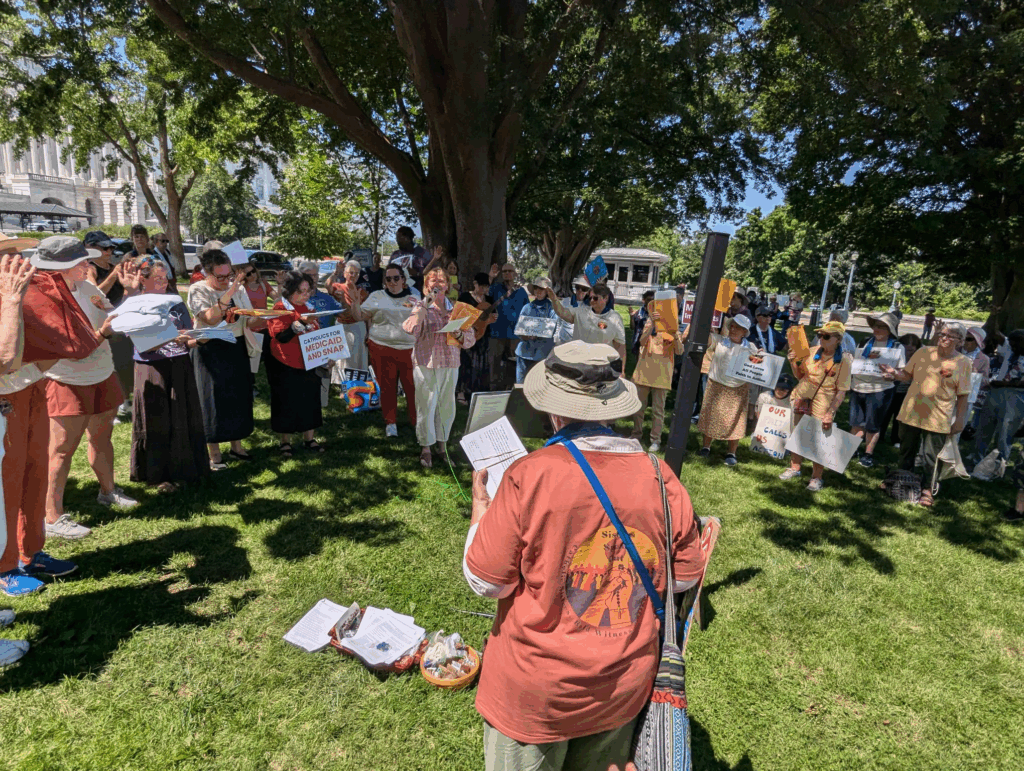

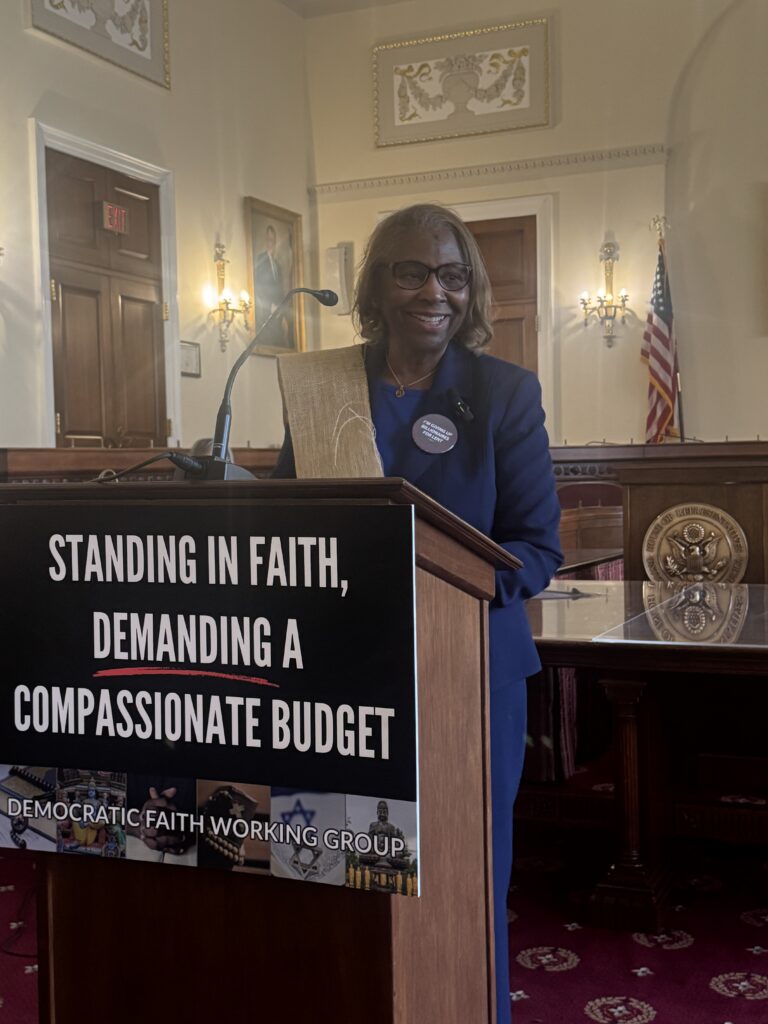

Catholic Cares Coalition and NETWORK Lobby have worked many years to develop vaccination logistic systems in developing countries. The hard deliberate work the faith community engaged in can be leveraged for future disease outbreaks including the next pandemic. However, the rescission package sets back this work for decades.

No one should be surprised about these funding claw backs. This is yet another insidious move from the Project 2025 playbook to dismantle all the parts of the government that right-wing political extremists like Stephen Miller and Russell Vought want to eliminate. This manipulation of a procedural move designed to prevent overreach by a former president is yet another example of how the president’s agency heads want to unravel the fabric of our society.

Finally, it also undermines the ability of our government to do things such as pass annual appropriations to fund the government. What reason will Democrats have to negotiate with Republicans on anything if they know Republicans will just claw back the funding?

Under the budget reconciliation bill recently passed by Congress and signed on July 4 by President Trump, we witnessed unprecedented cuts to health care (including Medicaid and the ACA), child nutrition, and other life-saving programs. Now in addition to these cuts, we further damage our country’s capacity to do good and access good, accurate information through news media. It’s a betrayal of trust and our system of government. This is an attack on our country’s history and tradition.