Congress and President Biden Must Take Domestic and International COVID-19 Action

Elissa Hackerson

May 13, 2022

How do you carve out a “new normal” in the calm days that follow the urgent times of a pandemic? Two years into life with COVID-19, people in the United States have yet to reach consensus on the path to achieve and maintain normalcy. Medical experts, governments, houses of worship, and ordinary citizens do not accept a uniform standard of safety and protection. Tensions arise over mask requirements in public spaces, vaccines and therapeutics are questioned, restrictions on large public gatherings are shunned, and the efficacy of booster shots is debated. In developed countries like ours, this is privileged discourse. Domestic and international COVID-19 infections persist, but most of us have taken the shot and are now blessed with significantly diminished threats of death and serious illness.

But what about our global siblings in under-resourced nations? How do they fare in places where jabs in the arm aren’t coming because of a lack of political will and resources? The short answer is, not well.

© UNICEF/Maria Wamala

COVID-19 vaccinations are being administered in communities hosting refugees, such as Fort Portal, in Uganda.

Globally, only 80% of people in lower-income countries have received at least one dose of a COVID-19 vaccine. The United Nations reports that of the more than 10 billion doses given out worldwide, only one percent have been administered in low-income countries. Here, there is no debate: citizens across the globe that don’t have an economy like ours, and thus lack access to life-saving vaccines and therapeutics, are suffering. They are ravaged by a pernicious disease tamed by remedies in our country because of economic and health inequities: lack of funds to secure the vaccines and therapeutics, well-resourced countries hoarding supply, and Big Pharma’s preference for patent control and profits over sharing the science for lower-cost vaccine production.

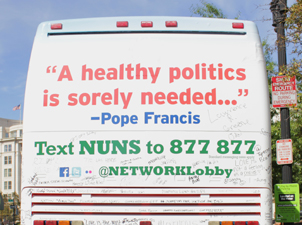

Last October, in remarks given at the World Meeting of Popular Movements, Pope Francis called on pharmaceutical companies to release vaccine patents to make COVID-19 accessible by the poor. He noted at the time that only 3%-4% of the population in some countries had been vaccinated. One would hope that Big Pharma and world leaders would reflect on that dismally low vaccination rate, heed the words of the Pope, and take action that values lives over profit. But that didn’t happen.

What can people of faith do? Be a pest for those in poverty here and abroad

In the Popular Movements meeting, Pope Francis recognized that some consider him to be a “pest” because of his unwavering defense of the poor and vulnerable. It doesn’t stop him in the pursuit of prophetic Christianity and it won’t stop NETWORK, either. As a member of the Catholic Cares Coalition, a national coalition of 60 Catholic religious and non-profit organizations promoting domestic COVID-19 vaccination and working to address COVID-19 vaccine and treatment equity in the U.S. and globally, we advocate for life-saving vaccine policies. Most recently, NETWORK signed on to a coalition letter urging Congress to pass a supplemental funding bill that prioritizes funding for ongoing domestic and international COVID-19 needs.

The pressure for domestic COVID-19 funds is necessary because nationwide, government money that secured hospital resources and rapid response measures during the height of the pandemic are running out. In our current landscape, if the government doesn’t pass a supplemental bill, it is likely that our “new normal” includes locking out Medicaid recipients, the uninsured, and the under-insured from free and deeply affordably COVID-19-related care, treatment and vaccines. It is critical that we provide funding which allows the United States to respond to these needs while also fulfilling our promises to assist those around the world.

NETWORK’s Request to Congress:

We support the Catholic Cares Coalitions request: pass the supplemental funding bill with at least $10 billion in domestic funding and $5 billion in international funds for COVID-19 vaccines, testing, therapeutics and delivery system strengthening.

What’s a TRIPS Waiver for COVID-19 All About?

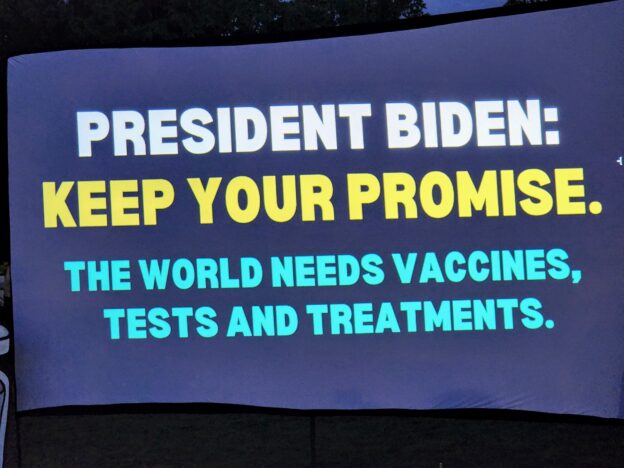

Laura Peralta-Schulte speaks at a White House candlelight vigil in May 2022 calling for a true TRIPS waiver.

The Trade-Related Aspects of Intellectual Property Rights (TRIPS) is an agreement created when the World Trade Organization was formed in 1995. This agreement restricts the rights to make and distribute patented medicines or materials, including COVID vaccines, testing and treatment, except under emergency conditions.

This Agreement, pushed by knowledge-based economies like the United States and the multinational, research-intensive pharmaceutical industry, imposed a base of protections for intellectual property rights, from patents to copyrights. Johns Hopkins University

In an effort to decrease pandemic deaths and illnesses, a COVID TRIPS waiver was proposed by South African and Indian governments to relax the intellectual property rights protections for medicines and technologies needed to prevent and treat COVID-19. This initial effort to release the science so lives could be saved was rebuffed by developed nations and pharmaceutical companies — who’ve thus far proven maximizing profits and maintaining control of monopolies is more important than saving lives. South Africa and India amended their waiver request so that it subsides in three years. The cap on the TRIPS waiver was intended to make rich countries and Big Pharma in Europe and North America feel better about lost profits and diminished control (in exchange for saving the lives of the global poor), but the measure has yet to draw support.

Are We Our Brother’s (And Sister’s) Keeper?

Humanitarian efforts to protect our global siblings should trump financial gains and political posturing. After all, the United States is privileged to benefit from Big Pharma’s vaccine supply. Don’t we have a moral obligation to help vaccinate the rest of the world? Pope Francis would say yes!. And so would Ady Barkan, the founder and co-executive director of Be A Hero. During his electoral campaign, Joe Biden promised Barkan that, “if the United States were to discover a vaccine, he would ensure that no patents stand in the way of other countries’ and companies’ mass-producing it.” As president, Mr. Biden has stated that patents and international trade agreements should not be allowed to prevent the affordable production of COVID-19 treatments.

Unfortunately, these have been empty pledges to date. Pfizer and Moderna, two of the companies that received billions of dollars in public taxpayer funding to develop their vaccines, have not shared their innovation with global scientists. This is particularly disturbing in the case of Moderna’s vaccine project which was completely funded by public money. While U.S. tax dollars fueled the Moderna vaccine, the company padded their profit margin, Moderna forecasts at least $19 billion in sales in 2022.

NETWORK and our Catholic and interfaith partners will continue calling on the U.S. government to share live-saving technology and know-how with countries in the global South so that they can begin developing necessary vaccines, testing and treatment for their citizens. For too long, access to healthcare has depended on the charity of rich countries which is neither predictable or sufficient. Justice requires ensuring countries must be able to protect the health and well-being of their own citizens especially in times of crisis. We must shift from an economy of exclusion to one that prioritizes life.

We Continue Putting People over Profits

Domestically, the appetite for COVID-19 prevention measures may be waning, but the disease is here to stay. We must not ignore it, and we must urge our leaders to diminish its ability to compromise health and take lives domestically and globally. Affordable access to shots, therapeutics, testing, and boosters are key as we continue to battle COVID-19 and any variants that emerge. It’s hard to accomplish this goal when the government funding that ushered us into our “new normal” is drying up.

Globally, even if the TRIPS waiver is granted, money will be needed to produce, transport, and administer the vaccine. Congress should act to address our obligation to take care of people at home and abroad in the supplemental COVID funding bill. Pfizer, Moderna, and other biopharmaceutical companies that maintain a monopoly on innovations created with public funds, cannot produce enough doses on their own to vaccinate the world. By protecting their monopoly, they deny billions of people access to vaccinations.

On May 12, 2022, the second Global COVID-19 Summit was held. Its co-hosts, the United States, Belize, Germany, Indonesia, and Senegal, called for global researchers, heads of states, philanthropic executives, and health experts to explore solutions — and make commitments — to “vaccinate the world, save lives now, and build better health security — for everyone, everywhere.” At the onset of the Summit, President Biden announced a major commitment to vaccinating the world’s lower-income citizens.

NETWORK believes this action, combined with the renewed and increased financial support from other global leaders in the West has the potential to be a game changer for global health and lives around the world. Through the National Institutes of Health, the United States has licensed 11 COVID-19 research tools and early-stage vaccine and diagnostic candidates to the Medicines Patent Pool (MPP) so that global manufacturers can use these technologies for the potential development of COVID-19 vaccines, treatments, and diagnostics to benefit people living in low- and middle-income countries.

According to the White House, new financial commitments were made at the Summit that totaled more than $3 billion in new funding above and beyond pledges made to date in 2022. This includes over $2 billion for immediate COVID-19 response and $962 million in commitments toward a new pandemic preparedness and global health security fund at the

World Bank.

See the White House’s account of global commitments made during the summit.

We know that the solution to COVID-19 lies in affordable and widespread access to vaccines, testing and therapeutics. We will continue raising our voices to the White House to oppose Big Pharma’s efforts to exacerbate vaccine inequity in the name of profit. We will continue to urge Congress to pass a supplemental funding bill that prioritizes funding for ongoing domestic and international COVID-19 needs; and we call on President Biden to continue working for an effective TRIPS waiver that makes lifesaving technology available to all.