Broadening Horizons: A Deeper Understanding of Poverty

Mary Cunningham

October 10, 2017

“You’re going to Burkesville, Kentucky!” the headline of my email read. As a senior, I had decided to lead a spring break immersion trip to Appalachia, where I would accompany 12 participants from my college to engage in a week of service, immersion and solidarity with the community in Burkesville, Kentucky. I thought I had a pretty good idea of what to expect, but as usual, I was surprised.

Leading up the trip I did not understand what rural poverty looked like. I grew up in northern Massachusetts in a small, upper middle class town. I spent one summer during college interning at a church in downtown Boston, an area known for its large population of homeless individuals and high-concentration of drugs. Having been surrounded by this on a daily basis, I thought I had a pretty good understanding of what poverty looked like. My trip to Kentucky changed that.

Burkesville, a small, remote town in southern Kentucky has a vibrant spirit and a strong sense of community. And yet, as my week there unfolded, I noticed signs of poverty. We worked at the Burkesville elementary school where many of the kids were on a nutrition assistance program. Although the school provided some snacks, they were often unhealthy options. Talking with school administrators, we also learned that there were not a lot of viable job opportunities in the area. There was a large population of children and retired people, but there seemed to be a lack of middle-aged people contributing to the economic growth of the town. Seeing a community struggling with these issues was something I had heard about, but never encountered.

As an associate at NETWORK, I recently learned about the rural poverty I saw in Burkesville from a policy perspective. On September 28, I attended a briefing titled, “Urban and Rural Poverty in America” in the Rayburn House Office Building. One of the things that stood out to me was how a city’s remoteness and population size are connected to poverty rates. Research collected by the Salvation Army shows that states that are more remote and that have both high and low population concentrations tend to have higher levels of need than states that are less remote. Rural towns located far from large cities tend to have a harder time accessing government services and their residents are often underemployed. It was clear from the panel that these unique challenges facing rural communities make grappling with poverty across our country difficult.

Another interesting comment came from one of the panelists, John Letteiri, who works for the Economic Innovation Group. Mr. Letteiri noted that the decline of migration is one of the major causes of exacerbated rural poverty. He cited an interesting statistic: since the 1990s migration from rural to urban areas has fallen about 50 percent. Without mobility, residents of these rural towns are attached to the economic reality of their area. As I left the panel, I was left with a sharp reminder of my experience in Burkesville, Kentucky.

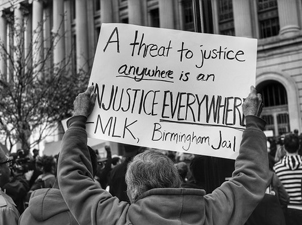

The way in which we understand poverty needs to constantly be reframed. We largely define poverty based on our own cultural perceptions, not the reality of the situation. As a society, we must take into account those who are forced into poverty due to social, economic, and political factors beyond their control and prioritize policies that support them. As poverty changes, so must our definition of it.

Catholic Social Justice also requires us to make a preferential option for those experiencing poverty. Prioritizing those with the greatest need must be done so that all are able to meet their basic needs and live in community. We can begin to mend the income and wealth gap by requiring everyone to pay their fair share of taxes. President Trump’s framework, if enacted, will expand the gap between those of living with ample means and those struggling to provide for their families.

Catholic Social Justice also requires us to make a preferential option for those experiencing poverty. Prioritizing those with the greatest need must be done so that all are able to meet their basic needs and live in community. We can begin to mend the income and wealth gap by requiring everyone to pay their fair share of taxes. President Trump’s framework, if enacted, will expand the gap between those of living with ample means and those struggling to provide for their families.