Our Work to Pass Build Back Better Continues

Julia Morris

November 9, 2021

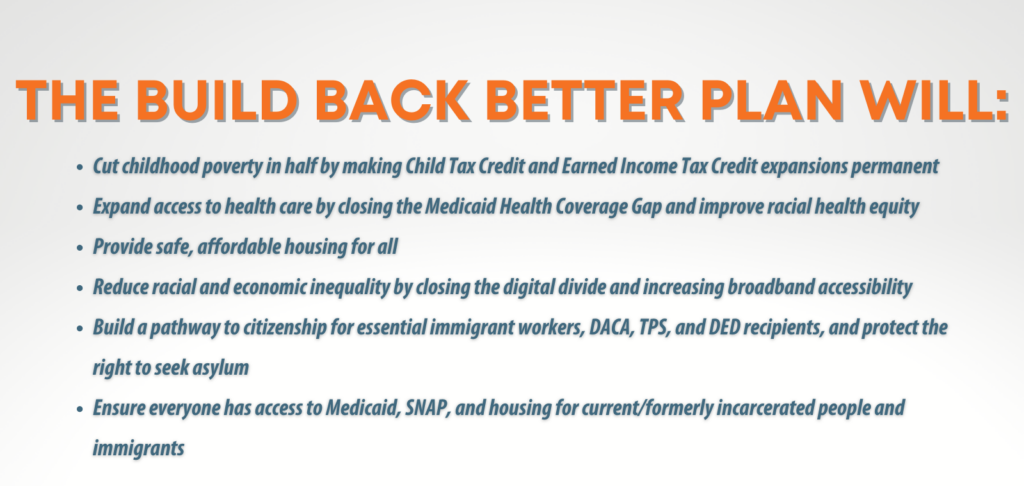

While we have been talking about the Bipartisan Infrastructure bill (H.R.3684) and Build Back Better Act for months, last Friday, the Bipartisan Infrastructure package passed the House and became law and a deal was struck between moderates and progressives on Build Back Better. While the Bipartisan Infrastructure plan includes important investments in affordable housing, safe drinking water, and broadband access, we need Congress to also pass the social investments in the Build Back Better plan to support families and communities. You can read more about the Bipartisan Infrastructure Deal on the White House website.

Together, both bills will make a spectacular investment to improve lives, create good union jobs, add a more sustainable environment, and more! Last week’s vote, agreeing on the rule for Build Back Better, will pave the way for investment in the care economy, a clean environment, and having the wealthiest pay more of their fair share for it all.

Five Democrats: Representatives Ed Case (HI-1), Josh Gottheimer (NJ-5), Stephanie Murphy (FL-7), Kathleen Rice (NY-4) and Kurt Schrader (OR-5); offered their tentative support for Build Back Better. If the cost estimate from the nonpartisan Congressional Budget Office is “consistent with the toplines for revenues and investments” outlined in the White House estimate, they will vote in support. With this commitment, the House went forward and passed the Bipartisan Infrastructure bill. This is in large part thanks to the Congressional Black Caucus’s two-step solution: passing the Bipartisan Infrastructure bill along with the rule governing floor debate for Build Back Better (H.Res.774).

NETWORK applauds President Biden, Speaker Pelosi, the Progressive Caucus and Moderates who are moving the whole package, both bills, forward. Now, we urge Congress to vote before Thanksgiving to begin making transformational investments that prioritize vulnerable communities. As the Build Back Better plan continues advancing in the House, we have to keep pressure on Senators Joe Manchin and Krysten Sinema of Arizona, neither of whom have yet to support the plan publicly.

Make your voice heard! Join us in emailing the Senate and House to show your support for Build Back Better.

Or write a letter to the editor supporting the Build Back Better plan here!

As Pope Francis said at the beginning of the pandemic, “it is necessary to build tomorrow, look to the future, and for this we need the commitment, strength and dedication of all.”

On July 13, 2021, the Senate announced that it had reached an agreement on a $3.5 trillion recovery package to be passed through the budget reconciliation process. This package, which is based on President Biden’s Build Back Better vision, together with the $1 trillion bipartisan Infrastructure Investment and Jobs Act, comes at a time when the COVID-19 pandemic has laid bare the gross inequity and lack of federal investment in our communities and infrastructure.

On July 13, 2021, the Senate announced that it had reached an agreement on a $3.5 trillion recovery package to be passed through the budget reconciliation process. This package, which is based on President Biden’s Build Back Better vision, together with the $1 trillion bipartisan Infrastructure Investment and Jobs Act, comes at a time when the COVID-19 pandemic has laid bare the gross inequity and lack of federal investment in our communities and infrastructure.

Right now, Congress is crafting their budget reconciliation proposal. Over the next weeks and months, our elected officials will decide what policy priorities to include and what to leave out.

Right now, Congress is crafting their budget reconciliation proposal. Over the next weeks and months, our elected officials will decide what policy priorities to include and what to leave out.

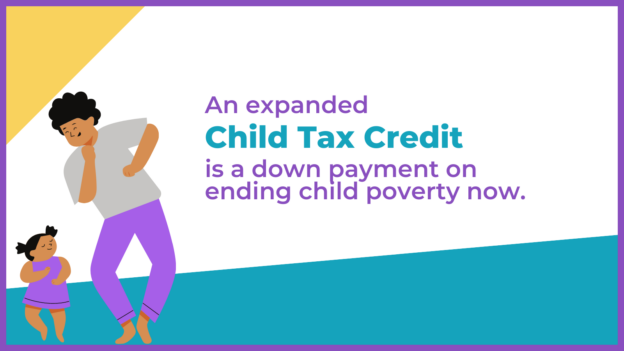

The American Rescue Plan, which passed in March 2021, included a historic expansion of the Child Tax Credit in 2021. The law increased the maximum Child Tax Credit from $2,000 to $3,000 per child for children ages 6-17 and from $2,000 to $3,600 for children under six, which can be received via monthly payments, with the exact payment varying by parents’ income. NETWORK has long advocated for this policy that uses our shared resources to invest in kids, increase racial equity, and support parents and communities.

The American Rescue Plan, which passed in March 2021, included a historic expansion of the Child Tax Credit in 2021. The law increased the maximum Child Tax Credit from $2,000 to $3,000 per child for children ages 6-17 and from $2,000 to $3,600 for children under six, which can be received via monthly payments, with the exact payment varying by parents’ income. NETWORK has long advocated for this policy that uses our shared resources to invest in kids, increase racial equity, and support parents and communities.