Five Key Tax Reforms Needed to Build Back Better

Audrey Carroll

September 9, 2021

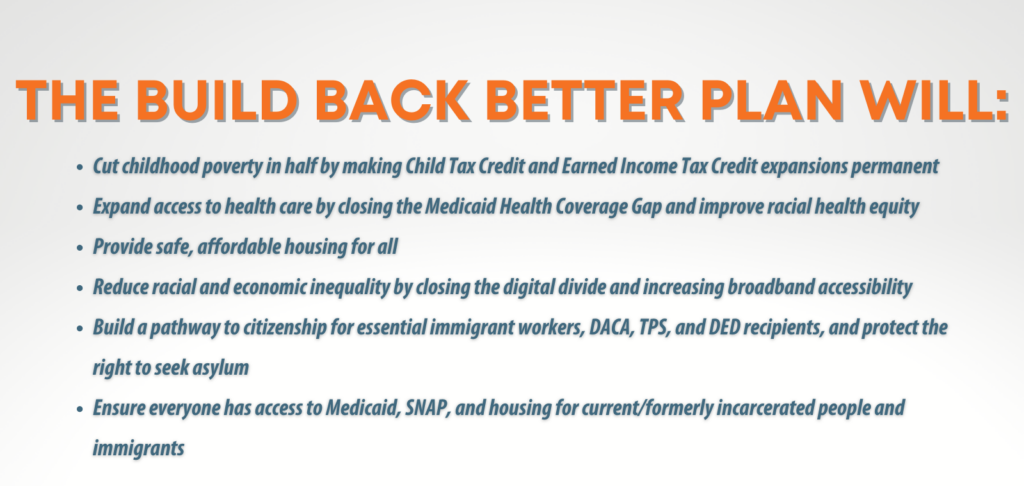

Right now, Congress is beginning markups of the Build Back Better bill. This recovery package offers once-in-a generation opportunities to invest in our families and communities and achieve the common good. We can fully finance critical policies that prioritize the needs of Black, Brown, AAPI, and Native American families and communities if the ultra-wealthy and tax-dodging corporations pay their fair share.

The Build Back Better Plan will be paid for by raising taxes on corporations and those earning over $400,000/year. Congress must responsibly finance a recovery package by reforming our federal tax code. Here are NETWORK’s key tax reform priorities for a faithful recovery in the Build Back Better plan:

Raise the corporate tax rate to at least 28%.

The 2017 Trump tax law cut the corporate tax rate from its long-standing level of 35% all the way down to 21%, far below what corporations had ever lobbied for. Raising it back to 28% will raise nearly $900 billion, enabling us to better invest in our families and communities.

Curb offshore corporate tax dodging.

The current tax code encourages corporations to outsource jobs and shift profits to tax havens because it taxes the foreign profits of U.S. firms at about half the domestic rate. The Build Back Better plan’s proposed reforms will take a big step to curb offshoring, raising more than $1 trillion, by doubling the tax rate on offshore profits and implementing reforms to stop shifting profits offshore to tax havens.

Tax wealth like work.

For people earning more than $1 million a year (the richest 0.3% of taxpayers), the plan will close the loophole that lets them pay a tax rate on the sale of stock and other assets that is almost half the top rate that workers pay on wages — 20% rather than the current 37%.

The plan also will close a loophole (called “stepped-up basis”) that lets millionaires and billionaires go their entire lives without having to pay federal taxes on most of their income or wealth. Taken together, these two loopholes allow billionaire Amazon chief Jeff Bezos to pay a tax rate similar to a public school teacher.

Restore the top individual tax rate.

The Build Back Better plan will restore the top individual rate to 39.6%, its rate before the Trump tax cuts. No one earning less than $400,000 a year will pay more tax.

Crack down on tax evasion by the wealthy.

Years of deep cuts to the IRS that resulted in much weaker tax enforcement of the wealthy and corporations must be reversed. The Build Back Better plan will invest in strengthening IRS enforcement and information technology and increase reporting of income to catch wealthy tax cheats.

An underfunded IRS focuses its audits on the regular taxpayers who can’t afford to fight back with expensive tax lawyers; an underfunded IRS also can’t offer robust customer support when regular taxpayers have questions or problems. A fully funded IRS has the resources to assist regular taxpayers with live customer support services while going after the biggest tax cheats.

Our communities need public investment in housing, paid family and medical leave, health care, and broadband technology that is racially, economically, and environmentally just. By reforming our tax code, we can afford much needed social programs that will help all people and families thrive.