Unpacking the 2022 Voting Record Webinar

Meg Olson

January 19, 2023

Watch the recording of our recent webinar “Unpacking NETWORK’s 2022 Voting Record: The Deep Need for Repair” — then take action!

Next, take action!

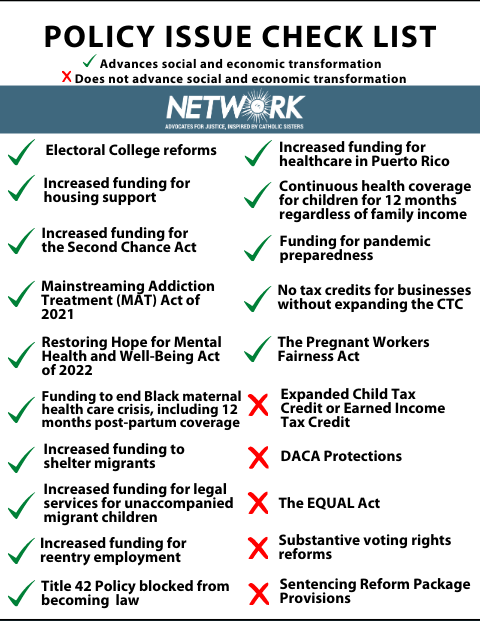

Visit our 2022 Voting Record web page where you can

- Download the 2022 Voting Record to see how your Members of Congress scored

- Send a quick email to let your Members of Congress know how you feel about their score

- Sign up to deliver the Voting Record to your Members of Congress. Once you sign up, a member of NETWORK’s Grassroots Mobilization Team will follow up with you to help you plan your delivery.