Taxes and President Biden’s American Families Plan

Colleen Ross

April 28, 2021

The American Families Plan, the second part of President Biden’s transformational plan for U.S. jobs and families, makes investments into our nation’s children, our education system, and our health care.

While some members of Congress have already begun a strong campaign against the plan’s changes to the individual side of the tax code, it is long past time to modernize the tax code and make it more just.

Here’s a look at the transformational investments in the American Families Plan:

- Extend the Child Tax Credit increases in the American Rescue Plan through 2025 and make the Child Tax Credit permanently fully refundable.

- Make the Earned Income Tax Credit Expansion for childless workers permanent.

- Extend expanded ACA premiums tax credits in the American Rescue Plan.

- Permanently increase tax credits to support families with child care needs.

- Expand summer EBT to all eligible children nationwide.

- Create a national comprehensive paid family and medical leave program

- Offer two years of free community college to all Americans, including Dreamers.

Read the White House summary of the American Families Plan here.

The American Families plan reverses the biggest giveaways that were passed in the 2017 tax law and reforms the tax code so that all contribute to our shared prosperity in a just tax system, including the wealthiest. These reforms are urgently needed at a time when economic inequality and the continued persistence of the racial wealth and income gap are harming our country. We cannot be a healthy country while systemic racism and economic inequality continue harming individuals and families in our nation.

For this reason, we support the tax reforms included in the American Families Plan which specifically address the ways that the tax code widens racial disparities in income and wealth. These reforms include:

Increasing the top tax rate to 39.6%

One of the 2017 tax cut’s clearest giveaways to the wealthy was cutting the top income tax rate from 39.6 percent to 37 percent, exclusively benefitting the wealthiest households—those in the top one percent. This rate cut alone gives a couple with $2 million in taxable an annual tax cut of more than $36,400. The President’s plan restores the top tax bracket to what it was before the 2017 law, returning the rate to 39.6 percent, applying only to those within the top one percent.

Enforcing compliance with the tax code

The American Families Plan would invest $80 billion to strengthen IRS enforcement, which has been decimated over the last decade and improve reporting on the income for high-earners. According to ProPublica, millionaires get audited at close to the same rate as workers with less than $20,000 of annual income. The Treasury estimates these enforcement improvements could raise $700 billion over 10 years.

Changing how capital gains are taxed

The biggest source of income for the wealthiest people in the U.S. is the profit they make from the gain on stock or other assets; this is known as capital gains. (This creates the much-talked about reality where Warren Buffet pays a lower tax rate than his secretary.)

The American Families Plan would partially fund the programs it proposes to invest in children and families by taxing income from capital gains like the taxes workers pay on their wages. It does this by closing two major loopholes that create the current system where wealth has a lower tax rate than what many middle-class workers pay on their wages.

Our partners at Americans for Tax Fairness explain how the plan closes these two loopholes:

- For people making more than $1 million a year, or the richest 0.3% of taxpayers, Biden wants to eliminate the nearly half-off tax discount they currently get when they sell assets at a profit. Instead of paying today’s top tax rate of 20% on the profits from the sale of assets like corporate stock, the rich would pay the same nearly 40% they already pay on their big salaries and other income. The current capital-gains discount is what allows a billionaire to pay a lower tax rate than a teacher or truck driver.

- Biden also wants to tax the wealthy on the accumulated gains of assets they inherit—gains that now go completely untaxed. The plan would only apply to gains over $1 million per individual, $2 million per couple ($2.5 million per couple when combined with existing real estate exemptions). This reform will narrow the wealth gap, limit the creation of economic dynasties, and raise revenue for services vital to all of us who do not inherit a fortune.

- Together, these two reforms would raise around $300 billion over 10 years exclusively from rich people. This will narrow the wealth gap and limit the creation of economic dynasties. It will also fund investments in healthcare, childcare, education and tax credits for working families that raise millions of children out of poverty. (The Tax Policy Center estimated a similar plan proposed by the Biden presidential campaign would raise $327 billion.)

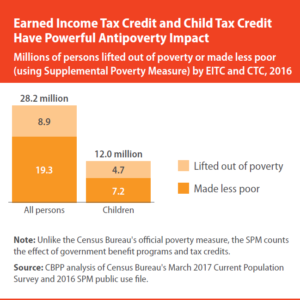

Improving the EITC and Child Tax Credit — through changes like those in the Working Families Tax Relief Act, recently introduced in the Senate — should be a key part of an agenda to reduce income inequality and boost working people’s wages.

Improving the EITC and Child Tax Credit — through changes like those in the Working Families Tax Relief Act, recently introduced in the Senate — should be a key part of an agenda to reduce income inequality and boost working people’s wages. Stephanie in Missouri, for example, explains: “I am a single working mom of four. My income is low, but I’m proud to support my family, running my own business from home which allows me to be here for my kids. Without the EITC my income would not be enough to cover our basic necessities, like food, housing and utilities.”

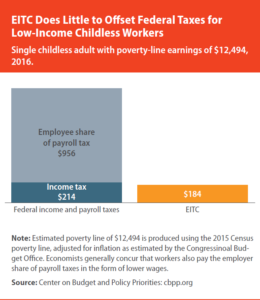

Stephanie in Missouri, for example, explains: “I am a single working mom of four. My income is low, but I’m proud to support my family, running my own business from home which allows me to be here for my kids. Without the EITC my income would not be enough to cover our basic necessities, like food, housing and utilities.” Despite their success, both the EITC and the Child Tax Credit have shortcomings that policymakers should address in order to target more assistance to those who need it most. The EITC for working people not raising children in the home is extremely small —

Despite their success, both the EITC and the Child Tax Credit have shortcomings that policymakers should address in order to target more assistance to those who need it most. The EITC for working people not raising children in the home is extremely small —  Putting its EITC and CTC expansions together, the bill would make a substantial difference for low- and moderate-income working families. A single mother of two earning $20,000 would get a $3,700 increase, for example, while a married couple with two young kids making $45,000 would get a $3,500 increase. The bill would cut child poverty by 28%, lifting 3.1 million children out of poverty and making another 7.7 million children less poor.

Putting its EITC and CTC expansions together, the bill would make a substantial difference for low- and moderate-income working families. A single mother of two earning $20,000 would get a $3,700 increase, for example, while a married couple with two young kids making $45,000 would get a $3,500 increase. The bill would cut child poverty by 28%, lifting 3.1 million children out of poverty and making another 7.7 million children less poor.