For A Better COVID-19 Relief Plan, Let’s #FundFamilies

Ness Perry

May 12, 2020

On Thursday, May 7, 2020, NETWORK Lobby and our partners Moms Rising, Children’s Defense Fund, First Focus, and The Coalition on Human Needs gathered virtually for a tweet storm encouraging Congress to #FundFamilies. This digital action aimed to ask for increased, consistent cash assistance for families and an expansion of the Child Tax Credit and Earned Income Tax Credit in response to the COVID-19 crisis. Social media is key to putting pressure on Members of Congress while in-person lobbying and hill visits are no longer an option.

NETWORK participated in the #FundFamilies tweetstorm because our faith teaches us to care for people at the margins in our country. Our economic recovery package should support those who need it the most, which is why we call on Congress to provide cash payments to every adult until the pandemic is over. This should be given to households that did not receive prior support from the CARES Act. This includes low- or no-income families that do not file tax returns, and families with ITINs including mixed-immigration status households.

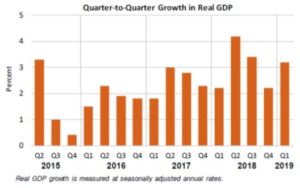

Families need direct aid, as well as credits in the coming tax season. We know that the Earned Income Tax Credit and the Child Tax Credit works, therefore we must expand it to provide aid for more families. The Child Tax Credit leaves behind more than 1/3 of children in families who earn too little to get the full credit — including 1/2 of Black and Latinx children. In order to mend the racial wealth and income gap, we must call on Congress to provide relief for all families, especially families of color.

Here are some highlights from the event:

Families struggling to make ends meet need more than a one-time $1,200 payment.

Here's what I'm calling for to help #WorkingFamilies:

▶️$2,000 stimulus checks every quarter for adults

▶️Expanding the Earned Income Tax Credit and the Child Tax Credit

#FundFamilies pic.twitter.com/5jCPsFLHeb— Sherrod Brown (@SenSherrodBrown) May 7, 2020

https://twitter.com/RepBarbaraLee/status/1258442973332869124

Moms like Faith need Congress to:

-Fund #childcare

-Expand direct cash assistance

-Increase and expand the #EITC and #CTC

–#FundFamiliesMoms like Faith should be to focus of the next #COVID19 relief package in Congress! RT if you agree! #Movement4Childcare #Childcare4All pic.twitter.com/mGsxk9IdDc

— MomsRising (@MomsRising) May 7, 2020

“I’m grateful for any sort of help we’re getting, but it’s not going to go far for us.” See why larger and recurring cash assistance could make a huge difference for Melanie and her family as they navigate the #COVID19 crisis. #FundFamilieshttps://t.co/OOmzrfzrg9

— Coalition on Human Needs (@Voice4HumanNeed) May 7, 2020

Putting money in the hands of families is the best way to prevent personal crises brought on by #COVID19. Join us in 5 min for a Twitterstorm calling on Congress to expand + increase #CTC and #EITC and provide direct cash payments of $2000 for kids and adults. #FundFamilies pic.twitter.com/T4wYrAARol

— Children's Defense Fund (@ChildDefender) May 7, 2020