Build Anew Series — Part 2

Immigration

Virginia Schilder

September 28, 2023

Welcome back to our new Build Anew Series, with weekly posts covering the people, policies, and values at the heart of the issues we work on. Today, in our second installation of the series, we’re focusing on Immigration.

- Part 1 – Introduction

- Part 2 – Immigration (below)

- Part 3 – Economic Justice

Our Present Realities

NETWORK Government Relations Director Ronnate Asirwatham at the September 2023 Welcoming Communities press conference on Capitol Hill

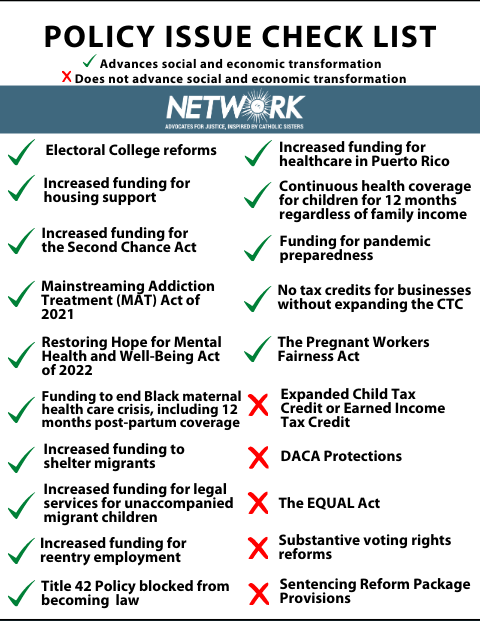

A lot has been happening in U.S. immigration policy, so NETWORK’s staff and faith-filled supporters have been hard at work. Over the summer, NETWORK opposed the Biden administration’s “asylum ban” and condemned the horrific mistreatment of migrants at the southern border. On August 31, NETWORK and our partners released a report detailing the horrors of the implementation of the new CBP One app, which US Customs and Border Protection has made the almost sole avenue for the asylum process. Please read the full report here, which includes several first-hand stories from people impacted. Then, on September 13, Catholic Sisters from across the U.S. joined NETWORK, members of Congress, and partners from the #WelcomeWithDignity Campaign on Capitol Hill at a press conference, where we called on Congress to invest in welcoming communities and divest from the militarization of the border. We presented Congress with a letter signed by over 7,000 Catholics(!), urging Congress to continue to fund the Shelter and Services Program (SSP).

We do this work because our broken immigration system fails to meet the needs of our siblings and make our communities truly safe. Right now, asylum seekers are forced to wait at the southern border in inhumane conditions, subject to assault, torture, kidnapping, and rape — violence to which Black, disabled, and LGBTQ+ migrants are particularly vulnerable. Many immigrants are detained in uninhabitable detention facilities, often torn from their families.

On top of that, racism in immigration policy persists, as Black and Haitian asylum seekers in our country are still being expelled and deported without a hearing. For those who have been granted paperwork to remain in the U.S., racist policies and practices make it more difficult for immigrants of color to access care, transportation, and other basic needs than white immigrants. As The Center for Health Progress explains,

“Until we clearly root out the inherent racism that is the foundation of our immigration policies, we will unlikely create an immigration system that is fair, just, and that creates a viable pathway for more immigrants to call the US home—something a vast majority of us, regardless of our political views, say we want.”

These conditions, and the policies that create them, continue because of fear — what Pope Francis calls “alarmist propaganda.” Politicians in power scapegoat immigrant families and create a fabricated competition for jobs and resources — even though our economy relies on immigrant workers, who comprise 17.4% of the U.S. workforce. This xenophobia creates a culture of fear and scarcity that hurts all of us.

The reality is, immigrants are already our families and our communities. A quarter of children in the U.S. have at least one immigrant parent. Yet, some people in power do not want to recognize immigrants as belonging to our communities, because that would mean acknowledging a responsibility for their wellbeing. The refusal to welcome immigrants is a refusal to share power; a refusal to extend to others the same rights, powers, and privileges we enjoy; a refusal to open our hearts to another and accepting the possibility of being changed.

Our Call to Welcome

As members of the human family, we are called to extend compassion interpersonally and structurally to people in need. In the same way that God’s love is not limited to country, our central commandment to love one another cannot stop at national lines. We cannot use borders to justify exclusion, to decide who “belongs” and who is an “alien.” Our faith invites us past the illusions of disconnection created by structures of oppression, and to instead recognize that we are of one global community, all children of God.

Scripture explicitly calls us to welcome and love migrants and refugees: “When a stranger sojourns with you in your land, you shall not do him wrong. You shall treat the stranger who sojourns with you as the native among you, and you shall love him as yourself, for you were strangers in the land of Egypt” (Lev 19:33-34). Borders should never be used as an excuse to turn away and ignore the real cries and suffering of our siblings.

The Catholic view of the human person validates the strivings of each person to seek a safe and good life for themselves and their families. The Catholic tradition is clear that all people have a right to migrate, and that all nations have an imperative to welcome and accept them. Pope Francis, himself the child of an immigrant, told a joint meeting of the U.S. Congress:

“On this continent, too, thousands of persons are led to travel north in search of a better life for themselves and for their loved ones, in search of greater opportunities. Is this not what we want for our own children? We must not be taken aback by their numbers, but rather view them as persons, seeing their faces and listening to their stories, trying to respond as best we can to their situation. To respond in a way which is always humane, just and fraternal.”

Catholic Social Teaching affirms that each person belongs to a single, interconnected human family, irrespective of country of origin or immigration status. We are all neighbors, and our health and wellbeing depend on each others’. The unequal and unjust treatment of our immigrant siblings is a critical area to build anew if we hope to shape a more just and inclusive democracy for everyone.

Ongoing Advocacy

Gratefully, we have the work of justice-seekers like NETWORK Government Relations Director Ronnate Asirwatham, who continues to work to ensure that both immigrants and the communities who welcome them will not be divided by racism and xenophobia. Currently in D.C., the bipartisan Senate is desperately trying to keep the government open. Meanwhile, some Republicans in the House are threatening to shut down the government unless H.R. 2 becomes law. H.R. 2 is a bill that separates families at the border and will hold unaccompanied children in jail-like conditions. No Democrat voted for H.R. 2 in the House, and it has not even made it to the Senate. Asirwatham explains,

“Many of our Representatives today are telling us that unless we throw our neighbors into the fire, they will shut down the government, and cut programs that help our children eat or go to school. We will not be divided. We will continue to tell our Members of Congress that we are for policies that lift us all up, and they should be, too.”

Join us again next week for our next installation of the Build Anew Series on a just economy. And, stay tuned for our upcoming Build Anew Series videos on Instagram (@network_lobby) and Facebook.