A Free, Voluntary, IRS Electronic Filing System is Essential for Low-income Taxpayers

JoAnn Goedert, Ignatian Volunteer Corp Member

Government Relations Special Contributor

May 24, 2023

Paying income taxes to the federal government has been obligatory since 1914. Even though we are all subject to federal tax laws for nearly 100 years, the Internal Revenue Service (IRS) has still not found a way to make it easy. The tax code is complex, and the process for calculating and filing pay payments each year can be daunting. Individuals with the means to afford the services of a tax professional, or electronic tax program, can minimize filing obstacles and maximize advantages in the tax code. But what about people of limited means? A free, voluntary, IRS electronic filing system would help all of us, but it is essential for low-income taxpayers.

The need for such a system has been recognized for decades, and its feasibility has been demonstrated by other countries, such as Australia, which have already implemented free direct e-filing for their taxpayers. In the U.S., as the gap between the wealthy and the middle-class grows, and working- and lower- class wages fail to keep up with the cost of living, the need for tax equity is more pressing. Lower wage workers, individuals with disabilities, and others living in the economic margins, deserve help navigating federal tax code and the IRS’s complicated tax forms and documentation policies.

But for many low wage workers and individuals with disabilities, limited help is available. Their options are to struggle with antiquated, handwritten tax forms that must be filled out and mailed to the IRS with paper documentation and any tax payment due; to contend with confusing and complicated requirements for limited, free IRS online filing; or to file no return because their income is so low that they owe no taxes. As a result, many individuals who can least afford to, miss out on tax benefits like the Earned Income Tax Credit and child tax credits, and they fail to document their eligibility for key federal supports like SNAP, Medicaid, and housing assistance – simply because of the intimidating tax filing maze.

What Does the Inflation Reduction Act Have to Do with Tax Fairness?

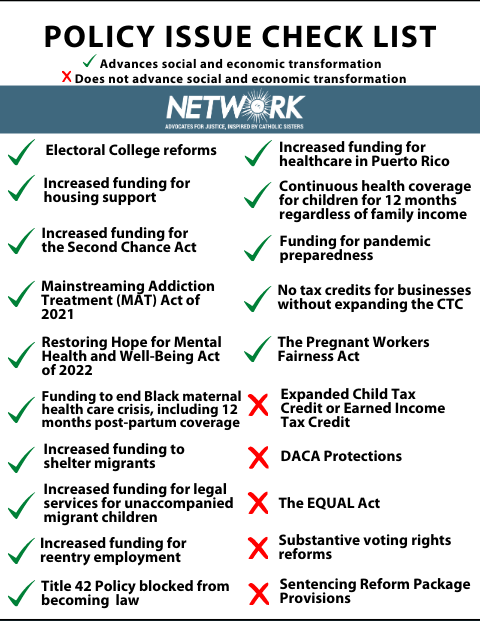

A new report gives us hope that a measure of tax fairness is coming soon, thanks in large part to a policy supported by NETWORK advocates, the Inflation Reduction Act of 2022 (IRA). The IRA set a requirement that the IRS issue a report on the feasibility of a free, direct e-file tax return system with a focus on multi-lingual, mobile-friendly features, and safeguards for taxpayer data to Congress before May 16, 2023.

Supporters of free, voluntary, IRS electronic filing emphasize that paying taxes is an obligation, not a privilege. As Nina Olsen, head of the Center for Taxpayer Rights and a former IRS official explained, “Let’s not forget that taxes are a public good. . . not a commercial product like potato chips or an airline ticket.” Accordingly, the government should provide a reasonable filing system for all taxpayers.

Opposition to free, voluntary IRS electronic filing

There is vigorous opposition to free, voluntary IRS electronic filing from big business. Commercial tax service providers and electronic tax preparation companies fear that making the process easier for some will diminish their profits. And some conspiracy theorists have conjured up “big brother” arguments against the program, casting it as an attempt by the government to collect and misuse financial information. Others with adequate means simply prefer the status quo.

NETWORK has supported free, voluntary, IRS electronic filing initiatives for years, and we are heartened by the Biden Administration plans, at last, to propose such a system later this month. We look forward to reviewing the Administration’s plan and working with NETWORK supporters and our partners to ensure that it provides the tax filing relief that our low-income earners need and deserve.