The Whole Body Suffers

This Black History Month Tests the Health of Our Union and Communion

Joan F. Neal

February 25, 2025

This Black History Month has been hard. I simply cannot sugarcoat it. Just as cold and flu season have ravaged so many people during the month of February, this month has also offered one terrible episode after another which should make all of us worry about the health of our country. The destruction of government infrastructure and institutions combined with the normalizing of racism and anti-immigrant sentiment have ravaged the U.S. in ways that put all of us more at risk of being less financially secure and even less healthy.

For years, the United States has been credited with having the “best health care in the world.” But if that is true, what else is also true is that access to that system is not equitably shared. Health care continues to be an issue for Black communities, and Black History Month reminds us of that fact. It shows us how the structures of society can be weaponized against people just as easily as they can promote stability and justice.

In the U.S., structural racism can be as simple as where a hospital or a grocery store is built; which communities can receive urgent, life-saving care and which lack even adequate transportation to access quality health care. Structural racism decides which neighborhoods have ready access to the fresh fruits and vegetables so essential for a healthy life and which communities are literal food deserts with only small grocery stores and limited options or fast-food outlets. Caring for our health involves both being able to access medical care when needed as well as being able to maintain good health by eating well.

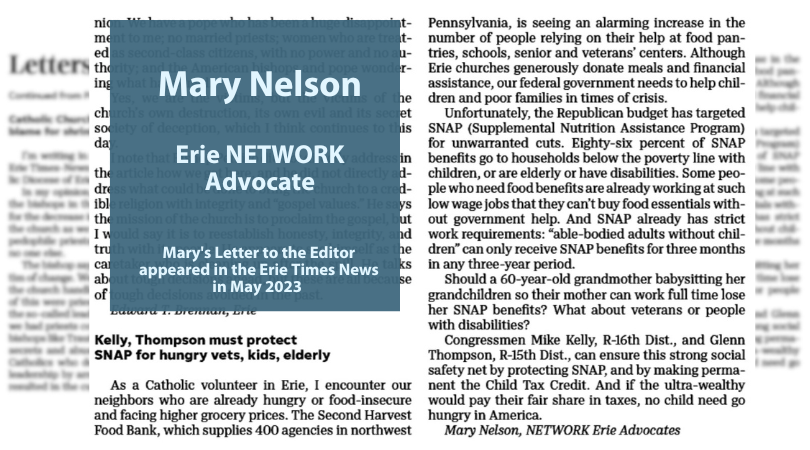

And while we may not realize it, these healthcare gaps are at the heart of today’s debates over the federal budget. Republicans in Congress have once again proposed to slash essential food and health care programs to give tax cuts to billionaires, balancing the budget on the backs of children, families, and ordinary people, many of whom are Black and Brown. These actions not only exacerbate the healthcare situation but also perpetuate the racial wealth and income gap and reverse the gains that Black History Month celebrates.

Families should not lose the ability to feed their babies through SNAP benefits in order to give Elon Musk another tax break. Nor should they lose their Medicaid in order for Jeff Bezos to further pad his considerable bottom line. Our very health and lives are literally caught up in this budget fight, and it is time for all people to speak out!

Families should not lose the ability to feed their babies through SNAP benefits in order to give Elon Musk another tax break … Our very health and lives are literally caught up in this budget fight, and it is time for all people to speak out! |

Troubling signs are all around us. At the beginning of February, the report emerged that Black women die at a rate nearly 3.5 times higher than white women around the time of childbirth, an increase from 2.6 times higher only a couple years earlier. The Black maternal mortality crisis is real, a concern of NETWORK, and just one of many indicators of persistent structural racism in U.S. health care. And if the proposed cuts to SNAP and Medicaid go through, they will be no exception.

NETWORK is fighting against these discriminatory policies through our new policy agenda: An Economy for All, which presents a clear plan to create an inclusive economy where everyone thrives – no exceptions. This is the vision that is central to the celebration of Black History Month.

Moreover, in areas such as health care, impacts spread. Scripture tells us that when one part of the body suffers, the whole body suffers (1 Cor 12:26). This is important to remember as the Trump administration rolls out its cruel and discriminatory agenda. No one can say “this won’t affect me.” Everyone should be concerned. This month’s Senate confirmation of vaccine skeptic RFK Jr. as Health and Human Services secretary portends a picture of a future where the health of all people in the U.S. will be weakened, where women won’t be able to get the health care they need, where children will die from easily preventable diseases, undoing decades of medical progress that made this country—and the world—healthier.

The whole body also suffers from the moral wound that is inflicted on society by the acceptance of racist policies, whether in health care, foreign assistance, or immigration. It is all morally unacceptable, and it hurts our souls to permit it, even passively. For U.S. Catholics, this Black History Month has tested our Union, the structures that enshrine “We the People” of the country. But it has also tested our Communion, our capacity to be one Body with all God’s children. If we are indifferent to our Black or immigrant friends or abandon our fellow neighbors abroad, we have lost our sense of Communion.

I believe that our country and the church are still healthy enough to rally and offer the moral witness necessary to fight off the harms of entrenched racism and Christian nationalism now ravaging our body politic. But it will require a renewed sense of solidarity, a commitment to being not just one people, but one Body, accountable to all its members without exception. That is a history well worth writing with our actions today.